Some Of Bankruptcy: Terms And Types - Types Of Bankruptcy

Table of ContentsNot known Factual Statements About 6 Types Of Bankruptcies, Which One Is For You- 8 Things You Must Know Before Filing Bankruptcy for DummiesGetting My Bankruptcy: Chapter 7 Vs. Chapter 13 To WorkThe Greatest Guide To Attorney For Bankruptcy In Camp Hill PaThe 7-Second Trick For Best Bankruptcy AttorneyHow Bankruptcy: How It Works, Types & Consequences can Save You Time, Stress, and Money.

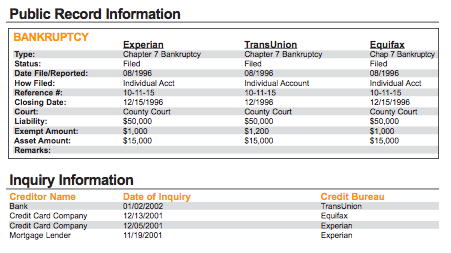

Lawfully, credit score report agencies can leave all 3 kinds of personal bankruptcies on your credit report records for ten years from your declaring day. Nonetheless, they typically eliminate completed Chapter 13 insolvency cases in 7 years. If you declare insolvency, learn just how it's influencing your credit by getting duplicates of your free credit rating reports from the three major credit score bureaus when you check out AnnualCreditReport. bankruptcy attorney.com.As you rebuild your credit report account, keep track of the changes by seeing 2 of your cost-free credit rating on Credit.com as well as enroll in your cost-free credit record card to develop or rebuild your credit scores. Choosing whether bankruptcy is right for you truly boils down to the nature of your financial debt and how susceptible you might be to your financial institutions.

A Biased View of Two Different Types Of Bankruptcies And How To Navigate

Student loans generally can not be discharged, other than in cases of severe challenge. Unpaid income taxes and child support may likewise not be eligible for discharge or a financial obligation payment plan. Likewise remember that you will certainly need to pay a filing feethe price depends on which chapter you apply for as well as what state you stay in.

Student loans generally can not be discharged, other than in cases of severe challenge. Unpaid income taxes and child support may likewise not be eligible for discharge or a financial obligation payment plan. Likewise remember that you will certainly need to pay a filing feethe price depends on which chapter you apply for as well as what state you stay in.It's a great idea to speak with a consumer bankruptcy lawyer accustomed to these legislations. The National Association of Consumer Insolvency Attorneys uses a tool to aid you discover a customer bankruptcy attorney in your area. A professional attorney can help you determine whether bankruptcy is best for you and also which Phase of bankruptcy is best for your offered circumstance.

Little Known Facts About 2 Types Of Personal Bankruptcy.

Insolvency has aided numerous Americans eliminate their debt concern and also obtain a clean slate. There are various types, so it is very important to recognize the distinctions and resemblances. Upsolve is a charitable that helps low-income families ease their financial obligation via Phase 7 personal bankruptcy at no charge. Begin today with Upsolve, or read to read more about the other kinds of bankruptcy.

You have actually tried whatever you can think about to return on your feet financially, but nothing has actually worked. Have you taken into consideration the sorts of personal bankruptcies that might aid you leave financial obligation and back on your feet?Your financial institutions are calling on a daily basis, and you dislike inspecting the mailbox for concern of getting notification of a financial debt collection suit.

The Best Strategy To Use For Understanding Chapter 7, 11, And 13 Bankruptcy

Do you qualify to file Chapter 7! .?. !? Should you submit Chapter 13!.?.!? What sorts of insolvencies can you file?The different kinds of insolvencies available to individuals are based upon the qualifications for each chapter of bankruptcy. The Insolvency Code state the certifications for each and every phase of personal bankruptcy. People might submit under the list below sorts of personal bankruptcies: Chapter 7 Liquidation Bankruptcy * Phase 13 Settlement Strategy * Phase 11 Big ReorganizationChapter 12 Family Members FarmersChapter 15 Used In Foreign Cases * The two most usual kinds of insolvencies for people in America are Phase 7 and Phase 13. Clean Slate Diaries" I'm going to be honest with you, pre-bankruptcy my credit history went down to a 543.

With the assistance of Upsolve, I feel complimentary once more. I have the capacity to develop myself right into something brand-new." Among the sorts of bankruptcies that you may think about filing is a Chapter 13 instance. A Chapter 13 instance is a repayment plan. You need to pay at the very least a part of the quantity you owe to unprotected financial institutions to a Chapter 13 trustee. These kinds of bankruptcies can assist a debtor keep their residence as well as vehicle if they lag on the financing payments.

The Facts About Six Types Of Bankruptcies Uncovered

A Chapter 7 personal bankruptcy case is a liquidation bankruptcy instance. A Phase 7 trustee is assigned by the court to carry out the situation. bankruptcy attorney near me. If the personal bankruptcy trustee identifies properties that have non-exempt equity, these properties may be offered by the Chapter 7 trustee to pay unprotected financial obligations. The majority of Phase 7 cases are no-asset situations.

These types of personal bankruptcies are a lot more usual than Chapter 7 cases that are taken into consideration property situations. Therefore, most borrowers submit Phase this content 7 and do not shed any kind of residential or commercial property, however they do away with countless bucks in unsecured debts. If this seems like the remedy for you, take a look at Upsolve.

Little Known Facts About Six Types Of Bankruptcies.

Numerous people have actually selected to eliminate their debts with our aid. You can too!When comparing kinds of insolvencies, the majority of people contrast Phase 7 vs. Phase 13. With a Chapter 13 instance, the bankruptcy payment strategy usually takes at least 60 months to finish. A lot of Phase 7 cases are finished within four to six months after the date you file your personal bankruptcy petition.

Numerous people have actually selected to eliminate their debts with our aid. You can too!When comparing kinds of insolvencies, the majority of people contrast Phase 7 vs. Phase 13. With a Chapter 13 instance, the bankruptcy payment strategy usually takes at least 60 months to finish. A lot of Phase 7 cases are finished within four to six months after the date you file your personal bankruptcy petition.A bankruptcy discharge alleviates your lawful duty to settle a financial obligation. Nevertheless, Phase 13 situations require you to pay off some of your debt back to creditors. Phase 7 instances do not have a repayment plan. Some debts are not eligible for a discharge in any one of the sorts of personal bankruptcies.